By no means have extra folks in additional international locations relied on finance apps to handle their lives and plan their futures. The rise in client dependency on fintech and insurtech apps for help and recommendation at each step of the journey opens alternatives for a brand new breed of finance firms that pivot to be a lifeline for his or her prospects. And the stakes are larger than ever as a result of digital-only has develop into the brand new norm for monetary companies.

Table of contents

-

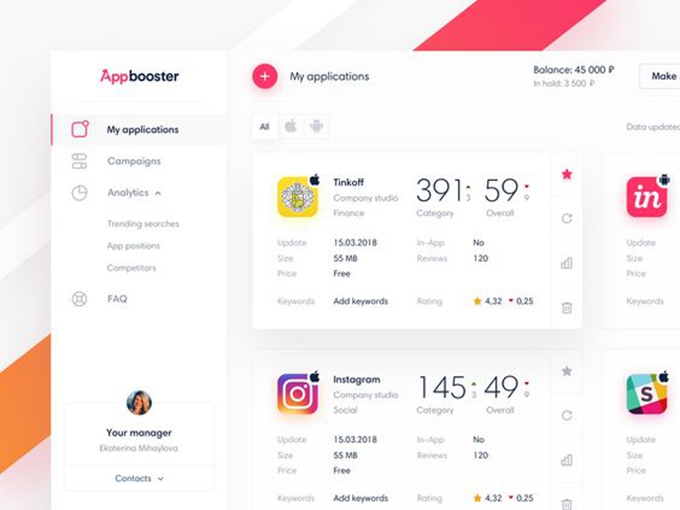

- Fintech Playbook Strategies

- boost oragnic downloads

- app rating service

- app store product page optimization

To understand this chance, entrepreneurs should domesticate the instruments and expertise to ship right-time, real-time experiences and individualized messaging that’s worthwhile and related. Communications at each stage should present genuinely useful (and human) recommendation.

Extra importantly, entrepreneurs ought to map what they are saying and the way they are saying it to important phases within the buyer lifecycle. Within the 2021 Rethink Fintech Playbook — the useful resource I wrote in collaboration with cell analyst Peggy Anne Salz — I’ve recognized 4 key phases and the actions entrepreneurs can take to drive constructive outcomes for patrons and their firms:

- Educate: Draw from a deep understanding of information and insights to individualize onboarding and encourage frequent app engagement and use.

- Empower: Mix advertising and marketing automation and personalization to assist prospects attain private finance objectives.

- Encourage: Harness knowledge to energy extra proactive, predictive, and personalised buyer communications that drive engagement and develop retention.

- Develop: Construct on confirmed success to gasoline long-term retention and form a extra customer-centric ecosystem.

It’s a brand new lens by which you’ll be able to view the client journey and align your communications technique and ways with buyer wants and expectations.

Buyer Training within the Advertising Combine

At this early stage within the journey, prospects are new to the app and wish help and recommendation in the mean time of friction. It’s right here that efficient entrepreneurs excel by their means to anticipate points and pre-empt issues. Additionally they succeed based mostly on their data-formed means to proactively recommend and suggest options and options to prospects who’re largely unaware of them and but extremely prone to profit from them.

It’s all about approaches that reimagine onboarding to supply proactive training, communication, and care. A first-rate instance is MOVii, a number one cell pockets and challenger financial institution in Colombia, on a mission to encourage larger monetary inclusion by offering merchandise that permit prospects to deal with and transfer their cash as merely as they use money as we speak.

The pathway is monetary companies which are accessible to, and understood by, everybody. This requires a brand new method to training enabled by messaging that turns into the trusted tutor, in line with Natalia Garcia Ocampo, MOVii CMO. In her view, the emphasis on training has profound implications for advertising and marketing organizations.

Personalised Training Reduces Churn

“Training has develop into a number one vertical contained in the advertising and marketing group,” Garcia says. In observe, the group divides efforts between buying, participating, and educating customers in line with their profile. “Enhancing and individualizing training is one in every of our predominant goals proper now.”

Utilizing CleverTap has helped MOVii perceive every buyer’s journey and the phase that individual falls into, Garcia says. Studying how customers get into the app and what they’re utilizing it for within the first place permits MOVii to floor provides and data that add probably the most worth on the crucial second. This additionally paves the way in which for infrequent customers to develop into high-value customers loyal for the long term, she says.

“Not everybody receives the identical sort of data and messaging as a result of not everybody wants the identical sort of coaching,” Garcia explains. A giant a part of training is making certain customers get unstuck and get help after they encounter issues or just have questions.

A first-rate instance is the registration course of, the place the regulation requires prospects to offer a selfie, proof of id, and proof of tackle. It’s right here that MOVii distills the information to see the place customers are getting caught and sends a personalised push to assist them proceed within the funnel. This individualized method to training, enabled by CleverTap, has allowed MOVii to cut back month-to-month churn by 82% — from 17% to three% — and drive file numbers of cell transactions.

“First, messaging wants to coach customers to develop into acquainted with options that assist them obtain monetary wellness.” Shifting ahead, she says, messaging wants to extend model consciousness and drive extra transactions.