The digital transformation of economic companies is extra apparent than ever. Through the COVID-19 disaster, some industries, together with the monetary trade, have been thought-about the “key” to the survival of the neighborhood. With this as an indication, the monetary companies trade has fully modified the way in which it makes use of technical companies and communicates with clients. As folks start to return to their regular lives, this evolution is a vital (however arduous) process to make sure financial success.

Table of Contents

- Digital Transformation

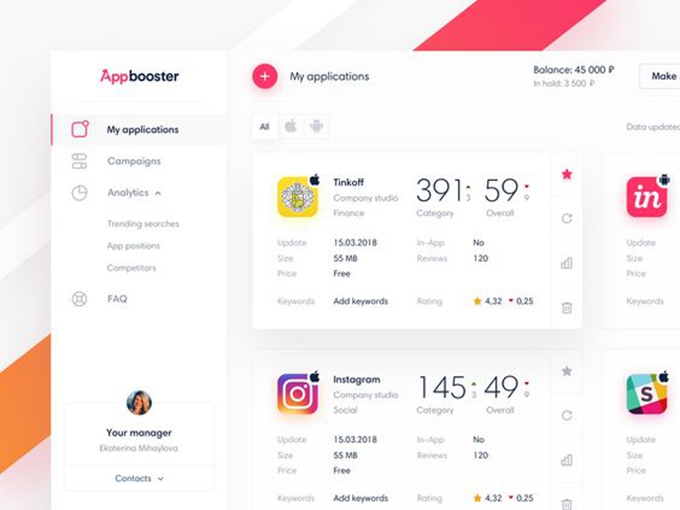

- android ranking service

- app ranking google play

- improve app visiblity

The Worth of the Digital Transformation in Monetary Providers

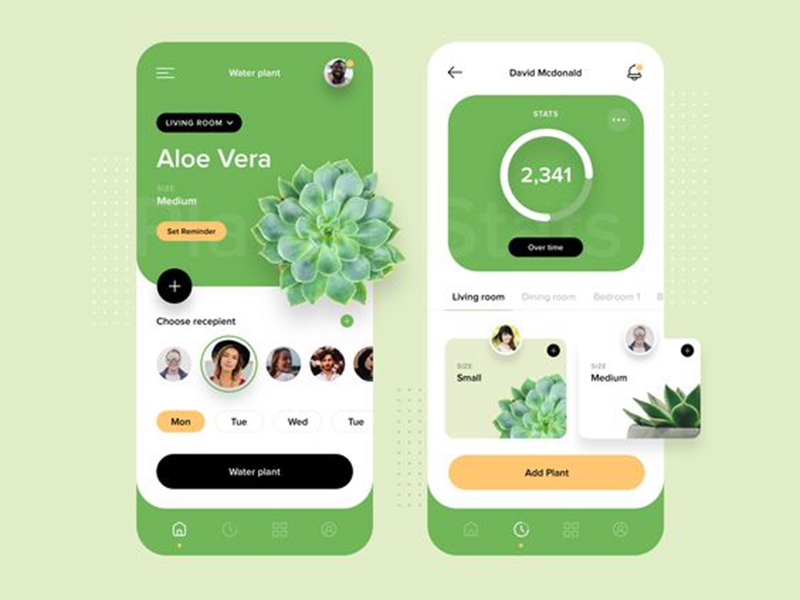

Even earlier than 2020, monetary establishments adopted new know-how to modernize their communication with clients. However with customers growing their app utilization by 20% throughout this time of disruption, buyer expertise administration has moved from a luxurious to a necessity in immediately’s world.

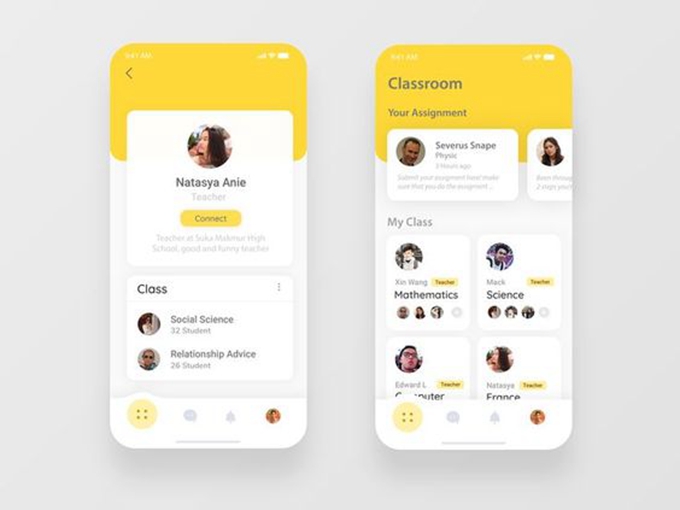

Naturally, digital transformation strengthens model communities as apps and social media enable clients to work together with their monetary professionals from anyplace on the planet. With generational wealth transitioning into the arms of millennials and Gen Z, assembly them on their (digital) turf is extra vital than ever earlier than.

From 2011 to 2017, Accenture analysis confirmed that digitally-focused banks noticed the hole between income and price greater than double that of their outmoded counterparts. This income progress might be attributed largely to offering a fantastic digital expertise, leading to happy clients who develop into model advocates and unfold the phrase to their households, buddies, and the 1000’s of strangers studying their on-line critiques and social media posts. Couple that with a latest Accenture examine displaying that fifty% of customers work together with their banks by way of a cell app or web site.

With Millennials set to inherit $68 trillion from their Child Boomer dad and mom within the coming years, being seen with a constructive on-line repute, staying top-of-mind on social media (corresponding to using Hootsuite repute administration), and creating a native search engine optimization technique are all vital steps to catching the youthful era’s eye (and belongings).

Utilizing On-line Repute Administration to Purchase and Retain Prospects

Prior to now, monetary advisors couldn’t use buyer critiques and testimonials to draw customers as a result of earlier legal guidelines from the Securities and Trade Fee. Nevertheless, latest modifications within the ruling now enable these teams to leverage critiques and testimonials in ads, offered that they meet particular standards.

This new ruling opens up a significant avenue in terms of buyer acquisition – particularly for monetary organizations following a technique that entails selecting which SEC-compliant critiques and testimonials to make use of of their promoting campaigns (for instance, with a overview widget on their web site like ReviewTrackers’ Amplify).

From the buyer standpoint, these critiques and testimonials function compelling content material to transform as a result of it’s the social proof they should see earlier than making a purchase order. The phrases of a client who had earlier expertise with an advisor or group lend extra credence to a services or products than the normal advertising and marketing lingo used for promoting. From an operations perspective, utilizing scores and critiques can scale back price as a result of utilizing client suggestions is free. As an alternative, extra funds can be utilized in different ways in which instantly enhance the client expertise.

Whereas these modifications enable for brand spanking new strategies of attracting customers, we nonetheless advocate checking along with your compliance workforce when participating in these actions.

To additional optimize spend, enhance buyer acquisition in banking, construct belief, and allow efficient finance customer support, establishments ought to mobilize their buyer base by gathering consumer suggestions, encouraging referrals, asking for critiques, and optimizing neighborhood administration efforts. Public posts by clients within the type of Google or Yelp critiques can instantly enhance a enterprise’s search engine optimization and search rating.

Buyer critiques knowledge reveals monetary companies as an entire is 4.06 out of 5 stars, which suggests there may be minimal danger and certain most reward in analyzing and publicizing buyer suggestions. When accomplished manually, this course of can eat away at useful time, however using particular platforms like ReviewTrackers and Hootsuite repute administration software program can velocity up and even automate this course of.

Translating the client expertise into critiques can have many advantages, starting from higher search engine optimization, certified lead era, and an improved consumer expertise. Monetary establishments can isolate buyer expertise analytics by consumer suggestions to gas clever enterprise decision-making with repute administration options. This may be accomplished for all suggestions or restricted to solely if you monitor app critiques, however it’s a highly effective instrument that shouldn’t be missed.

When compliance comes into query, using repute administration know-how and efficient social media methods allows monetary organizations to handle compliance requirements from the top-down. Along with granting company advertising and marketing groups peace of thoughts, this provides particular person brokers and advisors the autonomy to put up pre-approved social media content material and overview responses to additional interact potential and present purchasers.

The Lengthy-Time period Results of Digital Transformation in Monetary Providers

The digital transformation in monetary companies has allowed establishments to guard themselves towards environmental components nicely past their management, whereas strengthening their current communities and bringing in new (and youthful) enterprise.

The final inhabitants has adopted know-how as an integral a part of their lives. If monetary establishments select to leverage on-line exercise by responding to critiques, participating with clients on social media, and proactively listening to client wants, they will develop their buyer base by improved on-line experiences and rebuild belief in an trade that has seen a reputational deficit.