Beginning a FinTech firm is just not a simple feat. Not like common startups, Monetary Expertise (FinTech) startups have twice as a lot work to do to be able to set up a brand new firm. Since FinTech corporations are each companies and expertise suppliers, these startups have to make sure that they’re working optimally on every of those ends earlier than they will efficiently launch.

Table of Content

-

- How Can I Monetize my eCommerce Marketplace?

- guaranteed ios ranking service from asoworld

- buy app downloads and reviews

Should you’re serious about beginning a FinTech firm, there’s plenty of planning, analysis, and testing to be finished within the early levels of each enterprise and product growth. You’ll want to make sure that you have got a agency grasp on all issues associated to the monetary business, the forms of providers you wish to provide your prospects, and the viewers you wish to market to, amongst different issues. It’s comprehensible if you’re feeling overwhelmed. Fortuitously, there are some things you are able to do to higher put together your self for the journey forward.

Having partnered with a number of monetary tech corporations all through the years, we right here at Koombea know what it takes to make it as a small enterprise within the monetary world, particularly if you’re contemplating creating an app in your services. So, that can assist you get began, we’ve put collectively an inventory of key steps and important info that each one FinTech startups ought to know earlier than they embark on the method of beginning a FinTech firm.

Have a Clear Understanding of Each Finance Business and Expertise Laws

Anybody pondering of beginning a FinTech firm ought to have a eager consciousness of the laws that govern each the finance business and tech software program merchandise, similar to internet and cell apps. Monetary info is extraordinarily delicate and there are strict legal guidelines that decide the best way this information is shared, saved, and transmitted.

So far as laws are involved, totally different nations abide by totally different requirements. For instance, FinTech corporations within the European Union (EU) or these providing providers to EU members outdoors EU territories should adhere to the Basic Knowledge Safety Regulation (GDPR) laws for the transmission of client information, significantly when that information is being transferred outdoors the EU.

The U.S. at present doesn’t have a single legislation concerning the transmission of monetary information, and as a substitute, units authorized requirements relying on the kind of information in query. For instance, FinTech corporations that provide fee providers should adhere to the Fee Card Business Knowledge Safety Customary (PCI DSS). U.S. FinTech corporations are additionally topic to particular person state and federal legal guidelines. Many FinTech corporations are sometimes required to register with particular person companies, together with the U.S. Securities and Trade Fee (SEC) and Commodity Futures Buying and selling Fee (CFTD), to call a number of.

These laws are in place to guard each client and enterprise monetary information. Nonetheless, these legal guidelines (together with privateness legal guidelines) don’t simply apply to the information being transmitted between banking business gamers or fee processing corporations; in addition they apply to the information being accessed on internet and cell apps. For these causes, FinTech startups ought to guarantee any software program being provided to the general public is extraordinarily safe, particularly with reference to internet and cell functions. FinTech corporations ought to encrypt all information being transferred, arrange two-factor authentication methods for logging into accounts, and frequently monitor methods to forestall and deal with potential information hacks.

Decide the FinTech Providers You’ll Present

FinTech is a broad time period used to explain a variety of expertise services that facilitate monetary transactions or the administration of a person or enterprise’ funds. As a result of there are such a lot of various kinds of monetary options out there to customers and companies alike, it’s very tough for a single firm (particularly a startup) to offer each kind of FinTech service to prospects.

When you’ve got thought-about beginning a FinTech firm, it’s vital to slim down your providers to a particular area of interest, similar to common banking or lending. That means, you’ll be able to focus your time and assets on this space and work towards changing into a frontrunner on this area of interest. Under are among the various kinds of FinTech niches to select from:

- Basic banking

- Wealth administration

- Investments and buying and selling

- Lending

- Fee providers

- Cash transfers

- Forex trade (together with digital foreign money)

- Tax providers

- Cellular banking

- Payroll providers

- Credit score reporting and monitoring

- Knowledge safety

- Market analysis

Whatever the FinTech providers you select to offer to your prospects, it’s vital to make sure that you provide one thing revolutionary. You don’t must reinvent the wheel, however if you wish to stand out, be sure that your startup supplies an answer to a buyer want and in a means that hasn’t been finished earlier than. This may be completed in quite a lot of methods, however for startups, one of the best ways to face out and appeal to prospects is by providing a really particular service to a really particular viewers, similar to an app that gives monetary planning instruments to single moms or a mortgage lender comparability service for veterans.

Get to Know Your Viewers

Figuring out the forms of FinTech options your startup will present goes hand in hand with the viewers you’ll serve. It’s vital to know who you’re advertising to as a result of not everybody will discover a particular FinTech product helpful. For instance, for those who select to offer retirement finance providers, your target market shall be extra mature. Should you present mortgage fee comparability providers, your viewers generally is a bit broader.

Upon getting your target market set, it’s also possible to design your FinTech internet and cell app accordingly. That is essential to the success of what you are promoting as a result of simply as some monetary merchandise don’t essentially resonate with sure demographics, many app options is not going to be engaging to your goal market both.

Youthful audiences favor vibrant and animated graphics of their apps and are capable of navigate extra advanced functionalities. Extra mature audiences are likely to favor easy app options and simple info. Attending to know your target market with respect to their monetary wants and expertise preferences is an important step to take when beginning a FinTech firm as a result of selecting the flawed viewers to current your product to or providing an app they won’t discover helpful can hinder you from gaining loyal prospects.

Analysis Your Rivals

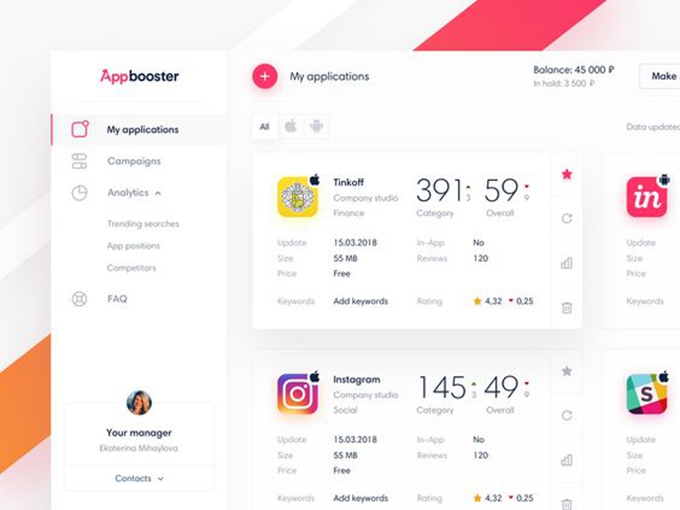

After figuring out your providers and target market, the subsequent step is to analysis your rivals. Take a look at among the high FinTech corporations in your space to see how they’re positioning their model in addition to how they’re designing their FinTech apps. This will provide you with a common concept of what you’re up in opposition to and the present FinTech tendencies that your potential prospects are searching for.

Select a Net and App Growth Firm

By now, you’ve in all probability already chosen a workforce of pros in your new FinTech startup. Nonetheless, it’s equally vital to pick the appropriate internet and app builders to make sure your software program is perfect and supplies a terrific Consumer Expertise (UX). Solely a world-class digital product will guarantee your startup’s success.