FinTech apps have remodeled the best way clients entry and oversee their monetary info. Relying on the actual goal of the appliance, a FinTech app could provide a variety of efficient finance options, together with on a regular basis cash administration instruments, inventory portfolio consolidation, funds planning assets, and retirement saving guides. Though FinTech apps could goal totally different audiences and buyer wants, the huge array of purposes which have been launched all through the years share one widespread objective: facilitating the consumer’s monetary administration expertise.

- Table of Content

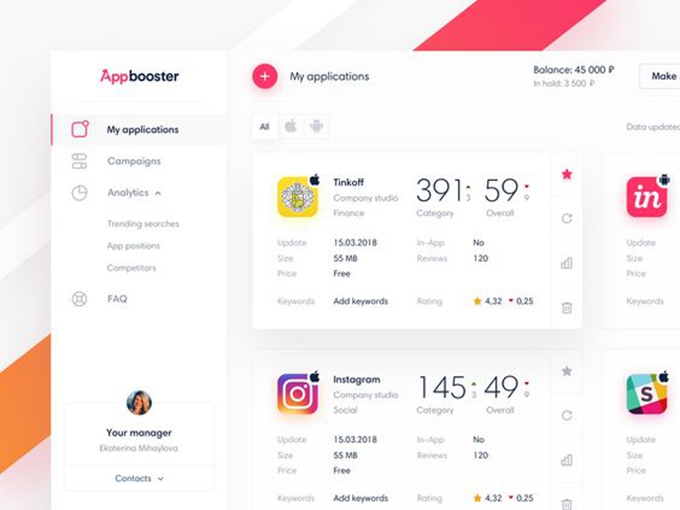

- Use Rounded Edges for Shapes

- guaranteed keyword ranking service

- google play short description

- aso ranking factors

If that is your first time making a FinTech app, it’s vital to acknowledge that you’ve got a particular viewers to cater to and that your app will home delicate knowledge that may be susceptible to hacks. First-time finance app builders can get carried away of their pleasure to construct the “excellent” app for customers, however could overlook key safety and accessibility options within the course of.

Beneath are 5 of the commonest errors that may happen when designing a brand new FinTech app and methods to forestall them.

1) Problematic UI

When you’ve determined upon the service you need to promote along with your FinTech app, the following and arguably most vital step is figuring out the precise design of your software. Very like an internet site, an app ought to be designed with a transparent intention and ought to be intuitive. In case your FinTech app’s Person Interface (UI) is poorly structured and inconsistent, not solely will you fail to draw your audience, however worse, you would possibly even get a foul evaluate.

Though there is no such thing as a cookie-cutter template for UI design, there are particular parts that ought to by no means be ignored when creating a brand new FinTech app. Beneath are a number of the most vital components to contemplate when designing your software:

Preserve Consistency

In case your app is in all places with various shade schemes, typography, and graphics, it’s going to ship the incorrect message to customers that maybe your providers are inconsistent as effectively. No matter shade palette and font kinds you determine to include into your app is totally as much as you, however all the time make sure that you repeat the identical patterns all through. Buttons, hyperlinks, menus, headers, and textual content ought to be styled in the identical method. The identical goes for the thickness of your line parts (divers, line breaks, and so forth.).

Hold it Easy

Finance-related instruments aren’t the best to understand, which is why your FinTech app ought to present clear and easy options in your customers that may be simply accessed. Whatever the explicit monetary topic your app will focus on, the options and total design of your software ought to be easy and uncomplicated.

In case your app is crammed with flashy parts or advanced fonts, there’s an excellent likelihood you’ll expertise points with rendering. It’s pure that you really want your design to be distinctive, however in the case of purposes, simplicity is essential. Not solely does a clear design promote ease of use it additionally helps forestall the app from crashing and sure parts from failing to show correctly.

Don’t Congest Components

Packing too many parts into your app can result in visible overload. If there’s a disproportionate ratio of graphics to textual content, your message will fail to return throughout to customers. Keep in mind that they’ll use your app on totally different display sizes. There’s solely a lot which you can embody in small display resolutions.

Use Rounded Edges for Shapes

Sharp edges and angles are harsh on the attention and make it more durable for customers to course of these parts visually. Sharp corners additionally seem brighter on display, which may result in consumer fatigue. Additionally they distract the consumer from what is definitely contained inside the form (resembling a name to motion), and as an alternative, draw the consumer’s consideration straight to the corners and away from the message you are attempting to convey. Rounded corners deliver the consumer’s focus to what’s inside the form, making it extra seemingly that they’ll click on on a button or icon, and finally, improve conversion charges.

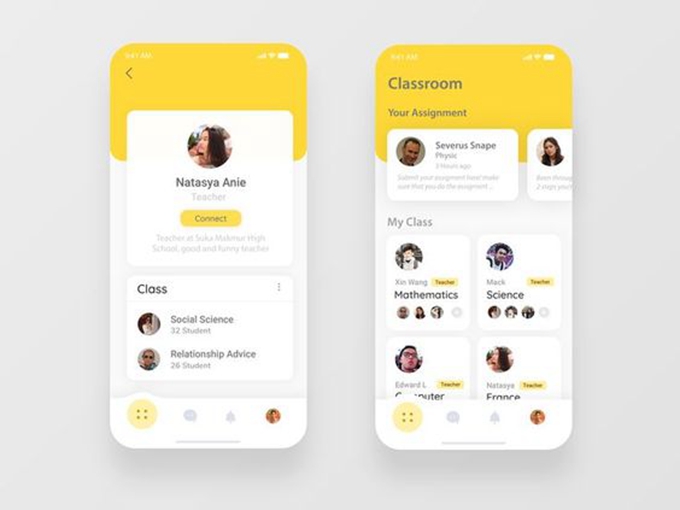

2) Poor UX

All monetary service suppliers need their clients to have a optimistic and seamless expertise when utilizing their FinTech apps. Nonetheless, that is simpler mentioned than executed. In case your app is just too difficult, it might discourage novice customers. That being mentioned, in case your app is just too fundamental, extra skilled customers can also be turned away.

It’s vital to obtain a steadiness between what could be perceived as “too difficult” or “too fundamental” when deciding what options to include into your app. Keep in mind that it is advisable to choose a audience and persist with the options they’ll relate to. You possibly can all the time create extra purposes sooner or later for various audiences, which will help you acquire authority as a number one FinTech app. However for now, stick to at least one format and focus on the UX side.

Bear in mind, the objective of your app is to facilitate Person Expertise (UX). Your FinTech app ought to make it simpler —not more durable— in your customers to handle their funds. A very good rule of thumb is to stay to at least one idea in your app, resembling retirement planning, for instance, and construction your app round that specific matter with out straying too removed from the preliminary objective.

Customers can get overwhelmed if too many instruments or advanced jargon are thrown their approach. Preserving your app user-friendly is all the time finest and can guarantee your customers take pleasure in a seamless and hassle-free expertise.

3) Failing to Take Your Goal Viewers Into Account

If you’re new to FinTech app growth, it’s possible you’ll be tempted to include all of the bells and whistles into your software so it stands out from these of your opponents. Whereas it’s comprehensible that you really want your customers to have a optimistic expertise utilizing your software program, finance-focused apps don’t want to incorporate all doable cash administration options.

Earlier than you get began, it’s essential to find out your audience. For instance, is your objective to help customers who’re in debt to discover ways to create a funds? Are you aiming to assist potential householders decide methods to improve their shopping for potential? These are all components to take note of when figuring out the objective of your app.

Customers are likely to gravitate towards apps that extra intently align with their wants. Customers don’t essentially need assist with all points of their funds. For those who exceed the wants of your goal market by creating an app with options your meant viewers could not relate to or discover helpful, you may very well discourage customers from downloading your app altogether.

For first-time FinTech app growth, the viewers you’re concentrating on is essential. Guarantee you’ve a transparent understanding of the imaginative and prescient in your answer and that it resonates with the wants of your potential customers.

4) Not Having Correct Safety Techniques in Place

Whereas any software wants to offer a safe platform for customers to change private info, the software program you’re integrating into your new FinTech App must have the best safety protocols in place due to the delicate nature of the info that’s being transferred.

Your customers are permitting entry to their financial institution, inventory, mortgage, mortgage, and retirement accounts via each internet and cellular platforms, so it is advisable to take the best precautions to make it possible for your software software program is updated and in a position to totally encrypt their knowledge. Failure to take action can result in a leak in your clients’ monetary info and probably trigger their accounts to be hacked.

Listed below are a couple of suggestions that will help you defend your customers’ private knowledge through the FinTech app growth course of:

- Design safety codes that may determine and block hack makes an attempt.

- Encrypt consumer knowledge and make use of a 2-step verification course of.

- Create a secured community for knowledge storage and carry out usually scheduled testing.

- Embrace real-time notifications to customers to assist determine unauthorized account login makes an attempt.

- Combine programs that may mechanically clear cache and create a seamless consumer expertise.

5) Failing to Account for Accessibility

When designing a brand new FinTech app, it’s essential to keep away from the error of not accounting for customers who could have a incapacity. Accessibility settings incorporate particular options that vastly enhance the consumer expertise by serving to them navigate an app shortly and simply.

Incorporating UX/UI enhancement options, resembling display readers, audio descriptions, customizable settings that enable for zoom and alterations to font measurement, shade schemes, and distinction in show all assist create a extra well-rounded software that can attraction to a broader vary of audiences.