Bounce to our picks for the most effective peer-to-peer cost apps:

- Greatest for fast transfers: Zelle

- Greatest for good friend teams: Venmo

- Greatest for buyers: Money App

- Greatest for frequent web shoppers: PayPal

- Greatest for digital pockets customers: Google Pay

- Greatest for Apple customers: Apple Pay Money

- Greatest for social media energy customers: Social media cash transfers

Peer-to-peer cost providers are apps or app options that mean you can ship cash to different individuals — usually by looking for their telephone quantity, e mail tackle or username — shortly and normally at no cost. Listed below are a few of the most typical P2P providers out there, together with the advantages and disadvantages of every.

Table of Contents:

-

- Peer-to-Peer Payment Apps

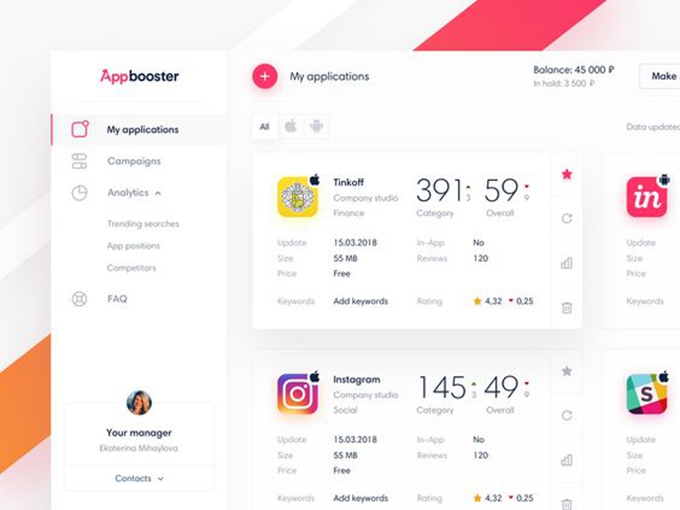

- keyword install android

- buy app reviews installs downloads

- google play keyword research tool

Zelle

What it’s: Zelle is a service that’s provided by most main banks within the U.S. and permits individuals to ship cash to different Zelle customers both via their checking account or the Zelle app.

The way it works: After establishing a Zelle account both via their financial institution or the Zelle app, customers can ship or request cash by getting into one other Zelle consumer’s registered e mail tackle or telephone quantity. If the recipient doesn’t have a Zelle account, they must set one up with the intention to ship or obtain cash.

Advantages:

- Cash transfers occur shortly. Cash transfers to different enrolled Zelle customers are inclined to occur inside a matter of minutes. If the recipient isn’t enrolled in Zelle, they’ll must enroll earlier than they will obtain cash.

- Zelle is appropriate with many banks and credit score unions. Fast, direct cash transfers between totally different banks and credit score unions is without doubt one of the greatest advantages of Zelle. In contrast to another cash switch providers, Zelle transfers cash instantly into your checking account, so that you don’t have to attend to maneuver it out of a third-party app.

Drawbacks:

- You may’t join a bank card to pay others. There are different peer-to-peer cost apps that permit customers to attach bank cards for cost, which might be useful if there aren’t sufficient funds in your checking account or app account.

- This service usually requires a smartphone. If Zelle is offered via your financial institution, you may normally use your financial institution’s desktop login to ship cash. In any other case, you’ll want a cell system like a smartphone or pill to ship and obtain cash via the Zelle app or your financial institution’s app.

- You may’t ship cash to worldwide financial institution accounts. Zelle solely works with home banks.

Venmo

What it’s: Venmo is an app that permits customers to ship cash to one another through linked checking account, Venmo steadiness or bank card. The service is owned by PayPal, but it surely has some totally different performance in comparison with PayPal’s peer-to-peer cash switch service. One in all Venmo’s most fascinating attracts is that the app additionally presents a free, elective debit card that permits customers to spend cash from their Venmo account steadiness.

The way it works: Customers obtain the Venmo app and create an account. They will then hyperlink a checking account or bank card to fund their Venmo account; then they will ship, request or obtain cash from different Venmo customers.

Advantages:

- Lots of people use Venmo, so it may be a handy option to go cashless. On the finish of the primary quarter of 2019, PayPal introduced that Venmo had 40 million customers, which makes it a extremely popular option to ship, request and obtain cash.

- Free, elective debit card. Customers who decide in to the Venmo card can use the debit card with retailers, and the cardboard will draw upon the consumer’s Venmo steadiness for funding. The debit card additionally offers customers money again for buying at sure retailers, which is added to a consumer’s Venmo steadiness.

Drawbacks:

- There’s a price to ship cash through bank card. Venmo fees 3% of the switch whole to ship cash through bank card.

- Venmo fees a price for fast cash-out transfers to your checking account. There’s a 1% price — with a minimal of 25 cents and a most of $10 — if you wish to switch your Venmo funds immediately to your checking account. In any other case you’ll have to attend one to a few enterprise days to obtain your funds at no cost.

Money App

What it’s: Money App is a cash switch app created by Sq. Inc. that permits individuals to ship cash through their Money App steadiness or linked checking account, bank card or debit card. The service presents an elective debit card — referred to as a Money Card — that permits customers to spend the cash of their Money App steadiness in addition to obtain “money boosts,” that are financial savings which might be utilized to numerous distributors.

The way it works: As soon as Money App is downloaded to a smartphone or pill, customers create an account and hyperlink a debit card, bank card or checking account. As soon as their Money App account is about up, they will ship, request and obtain cash from different Money App customers in addition to put money into shares and purchase and promote bitcoin.

Advantages:

- Free, elective debit card. Money App offers customers the choice to obtain a “Money Card” debit card that permits them to spend their Money App balances at totally different retailers.

- “Money boosts” can assist customers lower your expenses. Customers who’ve the Money Card can use Money App to activate “money boosts,” that are reductions with sure retailers which might be routinely utilized to a purchase order (e.g. 10% off of a DoorDash order). Just one money increase might be energetic at a time, however customers can simply change which money increase is energetic within the app.

- Customers can use the app to put money into shares and purchase and promote bitcoin. A singular function of Money App is that it permits customers to speculate their cash in particular person shares in addition to purchase and promote bitcoin, doubtlessly permitting them to earn cash via the app.

Drawbacks:

- There’s a price to ship cash through bank card. Money App fees a 3% price to individuals who use a bank card to ship cash.

- A price for fast deposits. Money App presents free customary money outs — which take one to a few enterprise days to deposit to your linked debit card — however if you need an immediate money out deposit, Money App will cost a 1.5% price with a minimal of 25 cents.

PayPal

What it’s: PayPal is a cost service that runs the gamut of serving to individuals with private cash transfers, on-line purchases and e-commerce. Utilizing PayPal as a peer-to-peer cash switch service, people can ship cash to one another through a linked checking account or a debit or bank card.

The way it works: PayPal presents many alternative capabilities, maybe the preferred being cost providers for on-line retailers and patrons. However PayPal additionally presents P2P cash transfers for registered customers. When you’ve created a PayPal account, you may ship and request cash by looking for one other consumer’s title, e mail or telephone quantity after which filling out the quantity you need to ship or request.

Advantages:

- The service is extensively used and has many cost capabilities. Along with peer-to-peer transfers, PayPal permits customers to purchase and promote on-line and is built-in with many on-line retailer checkout pages.

- PayPal has excessive switch limits. You may ship as much as $60,000 — however could also be restricted to $10,000 — in a single transaction. This quantity could range relying in your foreign money and whether or not your account is verified.

- There are a number of strategies of cost for transfers. Customers can ship cash with a debit card, a bank card, a checking account, PayPal steadiness and PayPal Credit score. PayPal Credit score is a person credit score line that’s provided by PayPal, and it may be used to ship cash to family and friends.

Drawbacks:

- There’s a price to make use of a bank card, debit card or PayPal Credit score to ship cash. Sending cash through linked checking account or PayPal steadiness are the one free methods. The opposite choices all cost a 2.9% transaction price, and PayPal Credit score has rates of interest which might be on par with bank cards.

- Transfers can take a while to maneuver to and out of your checking account to your PayPal account. Free transfers from PayPal to your checking account normally take one enterprise day however can take as much as three to 5 enterprise days relying in your financial institution’s clearing course of. If you wish to money out to your checking account instantly, PayPal fees a price of 1% of the quantity transferred, with a most price of $10.

Google Pay

What it’s: Google Pay is a digital cost app that permits customers to make purchases and cash transfers with a digital pockets.

The way it works: Google Pay is an app that may be downloaded to Android (working Android Lollipop 5.0 or increased) and Apple units (iOS 7 or increased) and permits customers to not solely ship one another cash but additionally pay retailers for items and providers if they’ve a point-of-sale near-field communication reader. Customers should obtain the app, register with a Google account and hyperlink cost and banking info. Then they’ll have entry to sending cash and making funds. Google Pay customers may also break up prices for hire, utilities and meals out with one another, and the app helps customers do the maths.

Advantages:

- Google Pay can be utilized at checkout with a number of retailers. Google Pay isn’t simply handy for P2P transfers; it may be helpful for day-to-day buying too. If a service provider has a point-of-sale system with an NFC reader, your smartphone has NFC turned on and also you’re enrolled in Google Pay, then you need to be capable to faucet your smartphone on the kiosk to pay. Google Pay additionally now permits prospects to activate promotional costs and reductions via the app and lower your expenses with retailers.

- It may be used on Apple units like iPhone and iPad that run with iOS 7 or above. Whereas the Apple Pay Money app works solely with different Apple product customers, Google Pay might be downloaded to Android and Apple merchandise alike.

Drawbacks:

- Solely out there within the U.S. For U.S. territories, Google Pay is just supported if a linked debit card was issued by a U.S.-licensed financial institution.

- You may’t use a bank card to ship cash. Google Pay doesn’t permit customers to hyperlink bank cards as a type of cost.

Apple Pay Money

What it’s: Apple Pay Money permits Apple customers to ship and obtain cash within the Messages app, which is appropriate with newer variations of iPhone, iPad, Apple Watch and Mac.

The way it works: Customers enroll in Apple Pay with their appropriate Apple system and, after linking a debit card within the Apple Pockets app, they’re able to ship, request and settle for cash from different customers via Messages.

Advantages:

- You should utilize Apple Pay at checkout with a number of retailers. Like Google Pay, the Apple Pay app could make retail transactions quick and handy. So long as you’re enrolled in Apple Pay, have an Apple system with expertise that helps NFC and are buying with a retailer that permits NFC funds, then you need to use the app to shortly pay for issues.

- Handy for Apple customers. In case your family and friends are a part of the Apple ecosystem, Apple Pay Money might be useful for sending, requesting and receiving cash.

Drawbacks:

- It doesn’t work with non-Apple units. Apple Pay Money is restricted to Apple units like iPhone, iPad, Apple Watch and Macs with acceptable working software program. Apple Pay Money can’t be used on Android units, which implies it is likely to be a restricted option to ship cash to family and friends in the event that they don’t have iOS merchandise.

Social media cash transfers

What it’s: Some social media and communication networks permit customers to ship peer-to-peer cash transfers to one another. Fb Messenger, for instance, permits individuals to ship, request and obtain cash through linked checking account.

The way it works: Customers can normally simply enroll in a social community’s P2P cost system by linking a checking account, debit card or PayPal account. After they need to ship or request cash, they will ship a cost message over the platform to a different enrolled consumer. If one other consumer is sending you cash, it ought to routinely seem in your linked checking account.

Advantages:

- Cash transfers normally occur shortly. If each events are already enrolled with a linked checking account, they need to be capable to ship and obtain cash instantaneously. Switch velocity could range relying on how lengthy it takes to enroll within the cash switch service or in case your financial institution takes some time to submit cash to your account.

- It’s a handy option to pay or request cash from family and friends. In case your family and friends are already utilizing the identical social networking web site as you, then it may be simple and handy to ship cash.

- Some apps permit customers to ship cash overseas. Fb Messenger permits U.S. customers to ship cash internationally, though some nations are ineligible for the service.

Drawbacks:

- Normally restricted to very primary switch options. Social networks don’t usually provide the extra bells and whistles of debit card presents or smartphone money register transactions. These social networks additionally won’t permit customers to ship one another funds with bank cards.

- The hazard of scams. Maybe extra so than different cost providers, social networks might be engaging to scammers since they’re way more private platforms. Be looking out for cost requests from different social community customers that you simply don’t know in individual or that appear out of character for individuals you do know. Cybercriminals can hack accounts or spin tales that should tug at your heartstrings earlier than they ask for cash. Some frequent ways embody romantic scams, lottery scams, donation scams, inheritance scams and mortgage scams.