- Table of Contents

- Facebook ad sales are up 46%

- Facebook Reports First Quarter 2021 Results

- app ranking service

- country target keyword installs

- buy app installs android

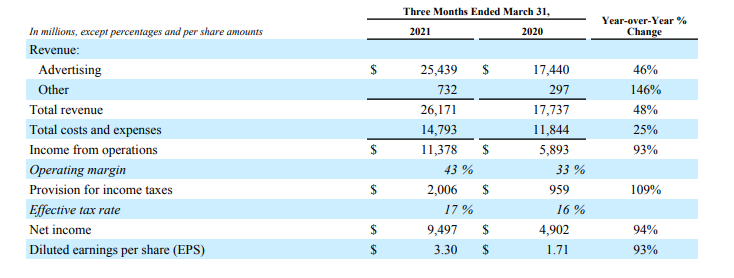

Fb ad gross sales are up 46%

Fb promoting gross sales jumped 46% throughout Q1 2021 in comparison with the earlier yr.

The social community’s newest earnings report reveals that the common worth per ad additionally climbed by 30% in comparison with 2020.

The variety of adverts delivered was up 12%.

Fb now expects that demand for its adverts will continue to grow throughout the yr, though it might be slower within the second half attributable to Apple’s new limits of ad monitoring.

The corporate is working to search out methods round it whereas retaining consumer privateness.

Day by day lively customers climbed 15% globally to 2.72 billion amongst all its high apps – Fb, Messenger, Instagram, and WhatsApp.

On the social community, every day lively customers jumped 8% to 1.88 billion.

Fb Reviews First Quarter 2021 Outcomes

MENLO PARK, Calif. – April 28, 2021 – Fb, Inc. (Nasdaq: FB) at the moment reported monetary outcomes for the

quarter ended March 31, 2021.

“We had a powerful quarter as we helped individuals keep related and companies develop,” stated Mark Zuckerberg,

Fb founder and CEO. “We are going to proceed to speculate aggressively to ship new and significant experiences

for years to return, together with in newer areas like augmented and digital actuality, commerce, and the creator

economic system.”

First Quarter 2021 Monetary Highlights

First Quarter 2021 Operational and Different Monetary Highlights

• Fb every day lively customers (DAUs) – DAUs had been 1.88 billion on common for March 2021, a rise

of 8% year-over-year.

• Fb month-to-month lively customers (MAUs) – MAUs had been 2.85 billion as of March 31, 2021, a rise of

10% year-over-year.

• Household every day lively individuals (DAP) – DAP was 2.72 billion on common for March 2021, a rise of

15% year-over-year.

• Household month-to-month lively individuals (MAP) – MAP was 3.45 billion as of March 31, 2021, a rise of 15%

year-over-year.

• Capital expenditures – Capital expenditures, together with principal funds on finance leases, had been

$4.42 billion for the primary quarter of 2021.

• Money and money equivalents and marketable securities – Money and money equivalents and marketable

securities had been $64.22 billion as of March 31, 2021.

• Headcount – Headcount was 60,654 as of March 31, 2021, a rise of 26% year-over-year.

CFO Outlook Commentary

We’re happy with the energy of our promoting income progress within the first quarter of 2021, which was pushed

by a 30% year-over-year improve within the common worth per ad and a 12% improve within the variety of adverts delivered.

We count on that promoting income progress will proceed to be primarily pushed by worth throughout the remainder of 2021.

We count on second quarter 2021 year-over-year complete income progress to stay steady or modestly speed up

relative to the expansion fee within the first quarter of 2021 as we lap slower progress associated to the pandemic throughout the

second quarter of 2020. Within the third and fourth quarters of 2021, we count on year-over-year complete income progress

charges to considerably decelerate sequentially as we lap intervals of more and more robust progress. We proceed to

count on elevated ad concentrating on headwinds in 2021 from regulatory and platform adjustments, notably the recentlylaunched iOS 14.5 replace, which we count on to start having an influence within the second quarter. That is factored into

our outlook.

There’s additionally persevering with uncertainty across the viability of transatlantic knowledge transfers in gentle of current European

regulatory developments, and like corporations throughout a variety of industries, we’re intently monitoring the

potential influence on our European operations as these developments progress.

We count on 2021 complete bills to be within the vary of $70-73 billion, up to date from our prior outlook of

$68-73 billion. The year-over-year progress in bills is pushed by investments in technical and product expertise,

infrastructure, and shopper hardware-related prices. We stay dedicated to investing for long-term progress and

our expense outlook displays the underlying energy of our enterprise and the compelling funding alternatives

we see throughout our merchandise, together with shopper {hardware}.

We count on 2021 capital expenditures to be within the vary of $19-21 billion, down from our prior estimate of $21-23

billion. Our capital expenditures are pushed primarily by our investments in knowledge facilities, servers, community

infrastructure, and workplace amenities.

We proceed to count on our full-year 2021 tax fee to be within the high-teens.